1. Financial Performance:

- Consistent double-digit growth for the past 5 quarters, ranging between 25-40%.

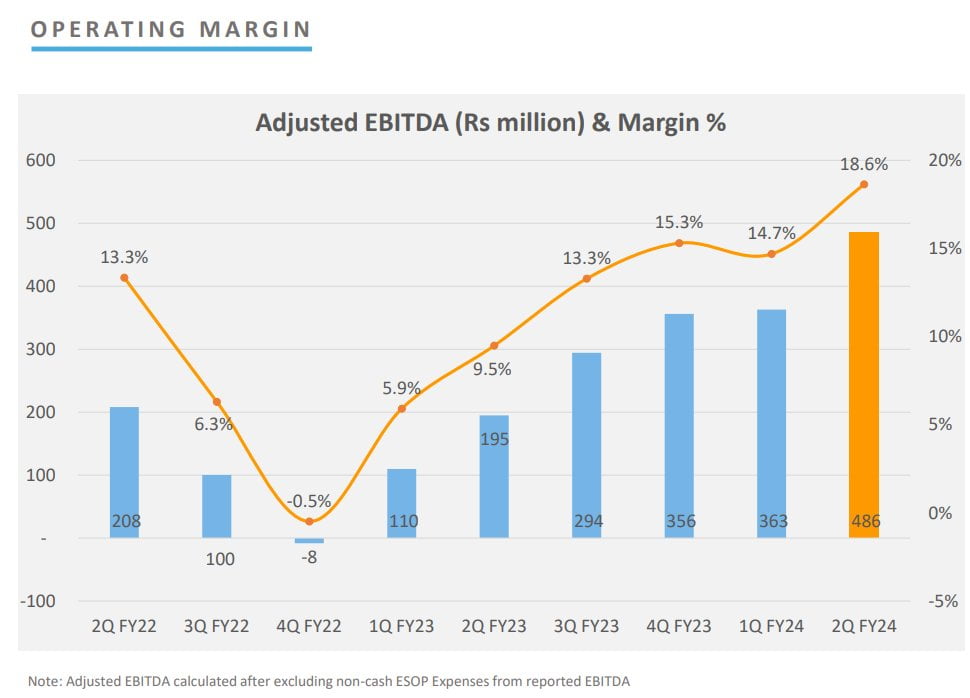

- Margins have shown significant expansion, moving from 5% to the current 19%, signaling a robust turnaround in the last 6 quarters.

2. Future Guidance:

- Management projects a 20% growth in revenue.

- Expected margin surpassing pre-COVID levels, aiming for 20%+ (25%) margins.

3. Valuation Metrics:

- Cash and investments stand at ₹4282 Cr, while the market cap is ₹5944 Cr.

- Enterprise Value (EV), excluding investments, is at ₹1662 Cr, indicating potential value.

4. Financial Highlights (H1FY24):

- Revenue up 27% at ₹260 Cr.

- EBITDA up 186% at ₹49 Cr.

- Net profit increased by 37.5% to ₹72 Cr.

- Collections rose by 21% to ₹278 Cr.

- Robust Operating Cash Flow (OCF) generated for H1FY24 at ₹108 Cr, marking a ₹50 Cr increase YoY.

- EBITDA run rate surpassing ₹200 Cr, with an attractive EV/EBITDA ratio of 8-9 times.

5. Operational Metrics:

- As of Sep ’23, 560,830 active paid campaigns.

- Database comprises 40.2 million listings, up 18.6% YoY.

- Quarterly unique visitors at 171.7 million, up 9.7% YoY.

6. Business Model Overview:

- JD is a leading Indian local search engine, digitizing small and medium businesses across India.

- Launched JD Mart, a B2B marketplace for SMEs in February 2021.

- Utilizes a subscription-based prepaid model with negative working capital and a net debt-free balance sheet.

- 62% of revenue from top 11 cities; 38% from Tier-II and Tier-III cities.

7. Services for SMEs:

- Offers a comprehensive platform for advertisers, mainly SMEs.

- Provides services such as listings, website creation, online payments through JD Pay, ratings and reviews, and enhanced reach through deals and catalogues.

Conclusion:

JustDial presents an enticing investment opportunity with its robust financial performance, favorable future guidance, attractive valuation metrics, and a well-established business model catering to SMEs. The company’s growth trajectory and diversified services for advertisers contribute to its appeal in the current market scenario. As always, investors are encouraged to conduct thorough due diligence before making investment decisions.